Smart ways to use a credit card

Posted on

#AD

Many people run to the hills when they hear the word credit card. It makes them think of unmanageable debt and something to be avoided. However, I’m here to tell you that’s not always true.

If used wisely, a credit card can actually have many advantages when it comes to managing your personal finances and even avoiding costly debt.

Read on to learn smart ways to use a credit card to manage your finances.

How I use credit cards to our advantage

Back in the day I used credit cards unwisely to, well, get into debt. I’m talking over 15 years ago when I was very irresponsible with money and got into a lot of personal debt in my late teens and hit debt crisis, ending up on a strict debt management plan to pay it all off over five years.

I swore I’d never get a credit card again, but I have now actually broken that promise!

For the past few years I have been using credit cards, but with a different approach.

In my teens I used them for buying things I wanted, couldn’t afford and didn’t realise I also couldn’t afford to pay back. Now I use them with a more sensible approach to manage our finances and to take advantage of the special offers that come with many credit cards.

So how do I use credit cards wisely?

Let’s take a look:

1. To accumulate rewards points

One of the first reasons I started using credit cards to manage our family spending was because of the rewards points. Some credit cards will give you loyalty points or cashback for every purchase on the card.

We simply put our regular monthly household shopping like fuel, food and entertainment on our credit cards and then pay it back at the end of the month using our wages.

Some of our household subscriptions, like Netflix, are even set up with our credit card as the payment method, so we can accumulate more loyalty points.

We know how much we are allowed to spend as it comes out of our monthly family budget. I track how much we have spent from each category on a spreadsheet and I can easily check our credit card balance using mobile banking apps, so we never overspend.

2. To take advantage of the 0% interest

Sometimes we make big household purchases. For example, our washer-dryer recently broke down and we needed a new one pronto! As a busy family household, it’s always on!

We do have an emergency fund, but this account has a bonus interest payment each month if we increase the balance each month. If I take the money out of our savings then we lose the interest for that month.

So, instead, sometimes when we make a big purchase like this I will put it on our 0% interest on purchases credit card instead.

It’s not that we don’t have the money in savings to pay for it, but it makes more financial sense for me to pay it off over a few months at 0% interest, rather than losing the interest we will make on our savings.

Of course, if we were ever in financial difficulty then I have peace of mind that we can access our savings and pay the credit card right back.

I always have 0% interest on purchases credit cards. These deals are sometimes for a few months, but I’ve had cards where it’s for 30 months!

It means there is no interest to pay on any purchases on the credit card for the duration of the 0% on purchases term.

If you do need to borrow money and can pay it back within the 0% interest on purchases period, then it’s a free way to borrow money as opposed to a loan with interest.

Used sensibly, a 0% on purchases credit card is a way to spread the cost of large purchases without having to pay any interest. Just make sure you can pay the full amount back before the 0% deal runs out.

Whenever my 0% deal runs out I always make sure I apply for a new credit card with 0% on purchases and when it arrives I will cancel my old credit card.

3. Added protection on our purchases

Purchases on credit cards that are between £100 and £30,000 also have the added protection of something often referred to as Section 75. This is a section of the Consumer Credit Act.

This means if an item arrives that is not as described and you struggle to get a resolution from the retailer, you can raise a claim with your credit card company who may be able to give your money back depending on the circumstance and evidence.

The same if a company goes bust or if anything else goes wrong with a purchase, then you may be able to get a refund.

4. For car hire when abroad

We have regularly hired cars when abroad and many of them require a credit card to hold a deposit on which can be hundreds of pounds.

If you are planning to hire a car when travelling or on your next holiday abroad then check the car hire companies policies as they may only accept a credit card, not a debit card, for holding a deposit.

5. To boost my credit score

Using credit cards and making my payments on time every month helps to ensure I have a good credit record and shows I am a responsible borrower. I never max out my credit cards and always have low balances, often paying off the credit cards in full each month.

This all helps to ensure my credit score remains high so I have a high chance of being approved for borrowing in the future i.e when it’s time to re-mortgage or if I need a home improvements loan.

Smart ways to use a credit card

As you can begin to see, there are lots of ways you can use a credit card to your advantage to benefit from loyalty points or cashback, to get 0% interest on large purchases and to make sure your large purchases are protected. You might even have to use a credit card when hiring a car when abroad.

But how can you ensure you don’t get into debt on your credit card and you use your credit card effectively?

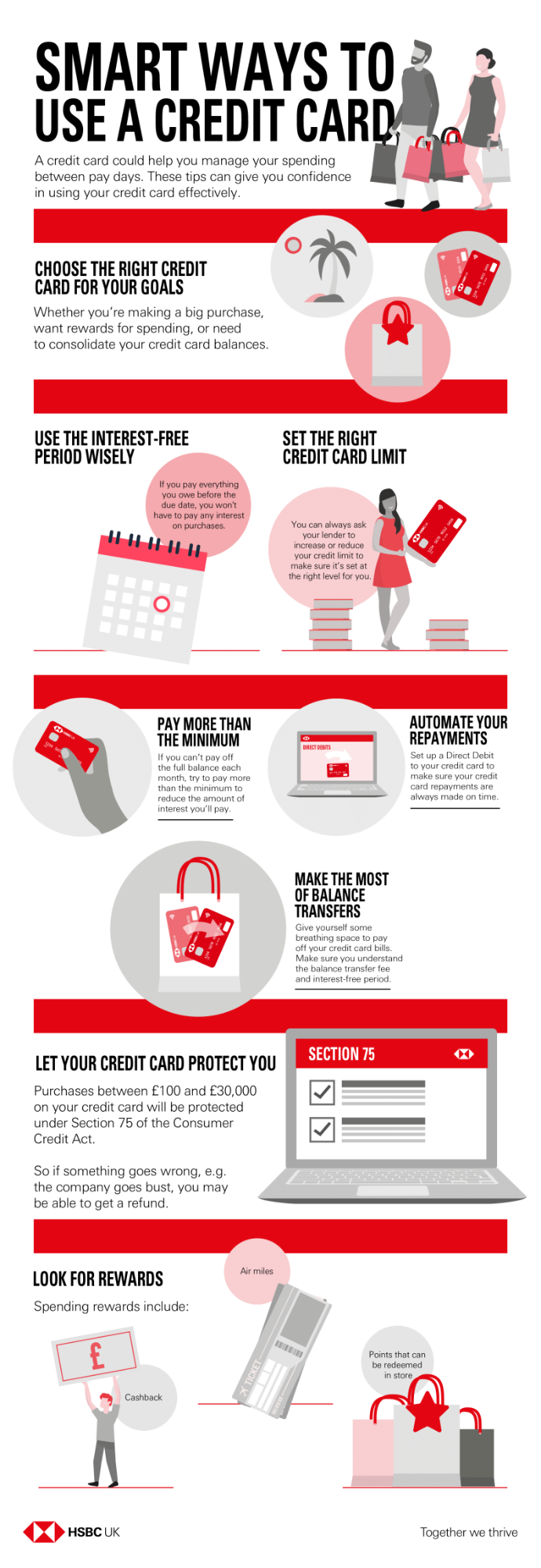

These tips from HSBC will help you:

- Choose the right credit card for your goals - there are different credit cards available with different purposes. If you are going to use it for everyday spending and pay it straight back then choose a rewards credit card. If you want to make a large purchase to pay back over time, then choose a 0% interest on purchases credit card. If you need to consolidate debt then choose a 0% interest on balance transfers (but be aware there is usually a fee for balance transfers).

- Use the interest-free period wisely - if you pay off everything you owe within the interest-free period then you won’t have to pay any interest on your credit card.

- Set the right credit card limit - you can remove the temptation to spend more by ensuring your credit card is set at the right credit limit. Lowering the limit might be advisable if it’s way too high and to avoid temptation to spend more than you need to.

- Pay more than the minimum - in an ideal world you will be paying the full balance off your credit card every month, especially if you are just using it for normal household spending, but if you can’t pay the full amount off then make sure you pay as much as possible. If your credit card is charging you interest then only paying the minimum balance each month will take you longer to pay it back and cost you more in interest.

- Set up a direct debit - never miss a payment by setting up an automated direct debit to always pay at least the minimum payment. You can always pay more yourself, but this will ensure you don’t ever miss a payment and will avoid any late payment or missed payment fees.

- Make the most of balance transfers - If you have a large credit card bill you need time to pay back and you are being charged interest then a balance transfer might work in your favour. Look for a credit card with 0% interest on balance transfers to give yourself some breathing space to pay off your credit card bills. These types of cards usually have a balance transfer fee, so check for online calculators to work out how much you will need to pay to transfer your balance to a different credit card.

Final thoughts

When used wisely and responsibly, a credit card can help you effectively manage your household spending and borrowing and allow you to reap the rewards such as loyalty points or cashback.

If used irresponsibly, however, then you can end up in unmanageable debt, so make sure your reasons for applying for a credit card are valid and not led by temptation.