Smart Money Management Techniques

Posted on

Effective money management is crucial for achieving financial stability and security. By managing your money wisely, you can budget for your expenses, save for emergencies and long-term goals, and make informed decisions about investing and borrowing. Good money management can also help reduce stress and anxiety related to financial concerns. However, many people struggle with managing their money, and as a result, they may miss out on opportunities to improve their financial situation.

In this article, we will discuss some smart money management tips and techniques that can help you take control of your finances and achieve your financial goals. Whether you are dealing with a tight budget, a large amount of debt, or simply want to improve your financial health, these tips can help you on your journey to financial success. You'd be surprised how much you can do with a few simple tweaks to your budget!

Smart money management tips and techniques for better personal finance

When you’re in your twenties, thirties, or even forties, you might think you have plenty of time left to save some money, secure your family’s future, or even plan for retirement. Unfortunately, 11.5 million people in the UK have under £100 in savings, and much of it is blamed on people’s trouble with numbers or feeling as though they have time to save later.

Some of the common mistakes people make when it comes to money management are:

1. Not setting goals and sticking to them

2. Spending too much on unnecessary things

3. Not paying attention to the interest rates on their loans and credit cards

4. Not following a budget and spending more than they earn

5. Failing to invest or save for retirement or emergencies

Honestly, a lot of it is common sense when it comes to saving - cutting outgoing costs, resisting the temptation to spend and having some willpower! Most of us could save more if we really wanted to and most of us could really do with learning some more money management skills to help us achieve our financial goals. So, even if you’re just in your twenties, thirties or forties, now is the time to learn the most basic keys of money management for your future. Let’s take a look at some of the most important money management techniques to set you on the right path.

In this blog post we will explore in more detail:

- How to avoid unnecessary expenses and impulse purchases

- Why you need to create a budget and stick to it

- Why you must pay off high-interest debt first

- Why you should set bigger financial goals

- Why saving for retirement is so important

- Why you need to write a will as part of your money management plan

- Why you should ask questions to financial experts

Let's go!

Avoid unnecessary expenses and impulse purchases

In today’s world, everyone is looking for ways to cut down on expenses and save money. One of the easiest ways to do this is by avoiding impulse purchases. We are all guilty of buying something impulsively at one point or another. Whether it was a new shirt that you didn't need or a new gadget you saw on TV, it's easy to give in to the temptation of wanting something right now. However, there are many things we can do to avoid unnecessary expenses and impulse purchases.

One way to avoid unnecessary expenses and impulse purchases is to plan ahead and make a budget. By taking the time to think about your financial goals and priorities, you can create a spending plan that aligns with your values and helps you make the most of your money. It's also important to keep track of your spending and stick to your budget, so you can avoid overspending and make sure you have enough money for the things that matter most to you. One great tip is to create a shopping list of items that you need for the week or month and stick to it. This will help you to avoid impulse purchases and make you more mindful of what you are buying.We'll cover the importance of making a budget for your finances in the next point.

The next step would be to use cash instead of credit cards when making purchases. This will allow you to keep track of your money better and not spend more than what is in your bank account. You can even use the cash envelope system to budget your money for the month and allocate it to different expenditures such as groceries, clothes, entertainment, transport, etc. Seeing the actual cash can stop you overspending as it’s physically there and not simply a tap on a card.

A great tip is to avoiding shopping when you're hungry or tired! These are surefire ways to overspend on food you don’t really need or to make bad purchasing decisions as our decision-making skills are impaired by hunger, thirst and fatigue!

Also, take the time to compare prices and shop around for the best deals. This can help you save money on everyday purchases, as well as on big-ticket items like appliances and electronics. By doing your research and being a savvy shopper, you can make sure you're getting the best value for your money.

Another way to avoid impulse purchases is to give yourself time to think before you buy. Impulse purchases are often driven by emotions, so it's important to take a step back and consider whether you really need the item you're thinking of buying. By pausing to reflect, you can avoid making impulsive decisions that you might later regret.

In addition to planning and thinking ahead, it's also helpful to avoid temptation by avoiding places and situations where you're likely to make unnecessary purchases. This might mean steering clear of shopping centres and other places where you're likely to be tempted by sales and special offers, including online stores! By being mindful of your spending habits and avoiding unnecessary expenses, you can save money and achieve your financial goals.

Create a budget and stick to it

There’s a good chance you’re making more money now than you did in your late teens or early twenties, especially if you were a university student living off of cup noodles and energy drinks! As a result of your lifestyle change, your budget should adapt. It’s easy for people to think that once they start making more money, they don’t need to focus so much on their budget and they can buy more expensive things.

While nicer things like a car or a new home may fit into your lifestyle and earnings now, they shouldn’t be purchases you make without first creating a budget. Now is the time to pay off old debts and dig yourself out of any financial holes so you can set yourself up financially to be able to make those mortgage and car payments without worry.

Creating a budget and sticking to it is an essential part of smart money management. A budget is a plan for how you will spend and save your money, and it helps you track your income and expenses so you can make informed decisions about how to manage your money. By creating a budget, you can see where your money is going and identify areas where you may be able to cut back on expenses or save more. This can help you avoid overspending and keep your finances on track.

Once you have created a budget, it is important to stick to it. This means tracking your spending, avoiding unnecessary expenses, and making adjustments as needed to stay within your budget. This can be challenging, especially if you are used to spending without a plan. However, sticking to a budget can help you achieve your financial goals and give you greater control over your money. It can also help you avoid overspending and the associated financial stress and anxiety. Overall, creating a budget and sticking to it is a crucial step in managing your money wisely.

So, take a look at your financial obligations, create a new budget for your lifestyle, and pay off any personal debt as quickly as possible.

These blog posts can help you re-think your budget:

- How to properly manage your salary and budget throughout the month

- How to overpay a personal loan + save money

- My honest debt story

- What to do if you’re struggling to manage your finances

- How to raise the cash for an unexpected bill

- What to do when you don't have the cash for essential household items

Pay off high-interest debt first

Debt is a huge burden on your finances, so it's important to get rid of it as soon as possible. You can begin to achieve this by first making more than the minimum payments on your debt every month.

Paying off high-interest debt should be a priority in your money management plan. High-interest debt, such as credit card debt, can quickly accumulate and become overwhelming, especially if you are only making minimum payments. This type of debt can also be expensive, as the high interest rates can cause your debt to grow quickly. By paying off high-interest debt first, you can save money on interest and reduce your overall debt faster.

Get rid of credit cards that have high interest rates, annual fees, or other penalties for missed payments first, but make sure you still make the minimum payments on your other credit card debt too if you have more than one credit card.

To pay off high-interest debt, you may need to make some changes to your budget. Consider cutting back on expenses, increasing your income, or using savings to pay off your debt faster. You may also want to consider consolidating your debt or refinancing to a lower interest rate. By making a plan and sticking to it, you can take control of your high-interest debt and move closer to financial freedom.

You can also look into ways to make more money on the side and put it towards your debt!

Save for emergencies and set bigger long-term financial goals

Once you have paid off any outsanding and high-interest debt or made it more manageable, you should focus on setting and achieving bigger financial goals. This may include starting an emergency fund or saving for a down payment on a house or car.

One of your goals should be to have an emergency fund that consists of at least six months of your average expenses. An emergency fund is a crucial part of any financial plan. It is a savings account that you can use to cover unexpected expenses, such as a car repair or medical bill. Having an emergency fund can help protect you from financial stress and prevent you from having to rely on credit cards or loans in case of an emergency. Also, if anything ever happens to your career or you find yourself without a job for a while, you’ll be comfortable as you look for a new one.

Saving for a down payment on a house or car is another important financial goal. A down payment can help you secure a loan with a lower interest rate and build equity in your home or vehicle. It can also reduce your monthly payments and save you money in the long run.

Don’t be afraid to think big, but make sure you’re working toward those goals and chipping away at them, rather than making impulsive decisions about where to spend your money once you’re out of debt. Overall, setting and achieving bigger financial goals can help you build wealth and achieve financial stability. It can also give you a sense of accomplishment and help you plan for your future.

Here are some helpful blog posts to kick-start your savings:

- How we saved £6500 in 6 months

- Why I’m saving an emergency fund before paying off my debt

- Why saving an emergency fund is a great idea

- 6 easy ways to save money as a family

- 3 tips to increase your family’s savings balance

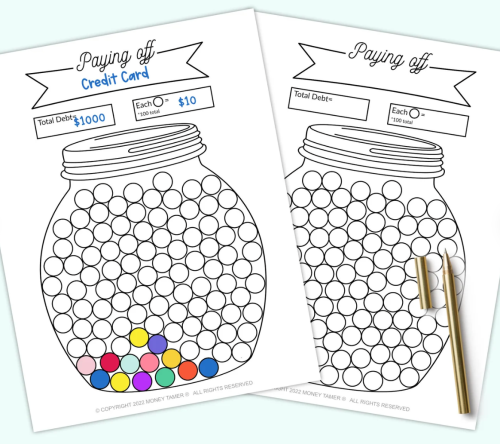

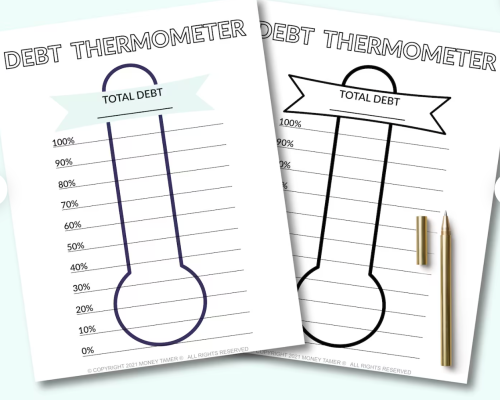

Debt thermometer tracker printable

Save for retirement

Yes, you can start saving for your retirement now. It might be years away but think about how much more comfortable your retirement years will be if you took the time to save up as much money as possible!

Saving for retirement as soon as possible is a smart money management technique for several reasons. First, the earlier you start saving, the more time your money has to grow through compound interest. This means that even small contributions can add up over time and result in a significant retirement fund. Second, starting to save early can also help you take advantage of employer matching contributions or other incentives that may be available. Finally, saving for retirement can provide peace of mind and help you plan for your future financial security.

By starting to save for retirement early, you can ensure that you have enough money to support yourself during your retirement years. This can help you avoid having to rely on the state pension alone or other sources of income that may not be sufficient to meet your needs.

Your budget might start to tighten up a bit as you work toward other goals in your life, like having kids or buying a house. So, plan out your goals carefully to include saving for retirement. If you don’t think you can do it on your own, enrol in a retirement plan at work, or talk to a financial advisor that offers retirement planning services about how to “automatically” put money away each month into a retirement account.

Check out these helpful articles on saving for retirement:

- Be eco-friendly with a climate-conscious pension from PensionBee

- Why you should start saving money now so you can enjoy your retirement

- Don’t rely on the state pension

- 25% top up on LISA retirement savings

- How to financially plan a comfortable retirement

Hardback monthly budget planner book

Be sure to write a will once you have monetary assets or a family

People should write a will as part of their personal finance management, even when they are alive, because it provides several important benefits. A will allows you to specify how you want your assets to be distributed after your death, which can help ensure that your assets are distributed according to your wishes and can prevent disputes among your heirs. A will can also help you appoint a guardian for your minor children, if necessary, and can help you minimize taxes and other expenses that may be due after your death.

In addition to these benefits, writing a will is important because it can also provide peace of mind. It can give you the confidence that your loved ones will be taken care of and that your assets will be distributed according to your wishes. This can be particularly important for people who have significant assets or complex financial situations.

It's a good idea to wise up on local laws such as for things like wills, inhertiance and probates and the costs involved, especially if you have a family and you're leaving assets and money to them should you die. You will want to maximize the value of your estate for your beneficiaries and may need some expert advice to do this.

Don't be afraid to ask questions

It’s easy to think you’ve got the world on a string when you’re in your twenties and thirties, but when it comes to money management, far too many people just don’t have the skills or financial background to feel comfortable with it. Unfortunately, that’s what often leads to mismanagement, debt, and the inability to reach your goals.

There is absolutely no shame in asking questions, doing your research, and talking to people who know how to handle money the right way. There’s a negative stereotype that people should be somewhat uncomfortable talking about money, but that’s not true!

You know by now that things aren’t going to be handed to you easily and that you’ll have to work for every penny you make. But, you probably also know that you don’t have every answer when it comes to what you should do with that money.

You’re in a season of life that could be filled with big changes, challenges, and growth. Don’t feel as though you have to go through your financial confusion on your own. Ask a financial advisor, accountant, or even a friend who is good with money management to help you straighten things out, reach your goals, and plan for the future.

Conclusion: The benefits of practicing smart money management

In conclusion, practicing smart money management can provide numerous benefits. By creating a budget and sticking to it, paying off high-interest debt, saving for emergencies and long-term goals, and investing wisely, you can take control of your finances and improve your financial health. Smart money management can also help you reduce stress and anxiety related to financial concerns, and it can provide peace of mind and confidence in your ability to manage your money.

In addition to these benefits, practicing smart money management can also help you achieve your financial goals, such as buying a house or car, retiring comfortably, or building wealth. It can also provide opportunities for growth and success, and it can open doors to new possibilities and experiences. Overall, the benefits of practicing smart money management are numerous, and they can help you live a happier, more fulfilling life.

Want to make more money online, at home or need a side hustle?

There are lots of real ways to make money from home for free. Find loads of ways to make extra money at home on my blog, as well as my favourite side hustle in my matched betting blog!

To get started, you can make money online in the UK with these 60 ways I’ve tried and tested.

Follow these steps to make £1000 in one month at home.

Or, if you’re short on time, try these methods to make money in one hour.

Love sharing great offers with friends? Make extra cash with these refer-a-friend schemes.

Want to save more money or get free money?

Check out my massive money-saving tips section and find some great deals on my voucher codes and how to get free money UK pages!

Check out my list of UK apps that turn receipts into cash and also this list of UK cashback sites to maximise your free cashback and savings.

Want to manage your finances better?

Here are loads of family finance tips and helpful debt articles.

Check out my massive money-saving tips section and find some great deals on my voucher codes and free money pages!